Mortgage Products & Programs

Explore our most popular solutions. Whether you're buying, refinancing, or rebuilding — we’ve got you covered.

Mortgage Products

Whether you're buying your first home, renewing your mortgage, or exploring better options — we offer personalized solutions

to match your needs. Explore our key mortgage services below and see how we can help.

Purchase

Achat

We can help make the biggest purchase of your life easier.

Refinance

Refinancement

Don't miss out. Equity takeout for renovations, leisure, education and more.

Renewal

Renouvellement

At your renewal, let us negotiate a better rate with no fees.

Switch/Transfer

Transfert

Let us do the shopping. Transfer your existing mortgage and save.

How It Works

Comment ça fonctionne

We’ve made the mortgage process simple. Whether you're a first-time buyer or refinancing, follow these three easy steps to move forward with confidence.

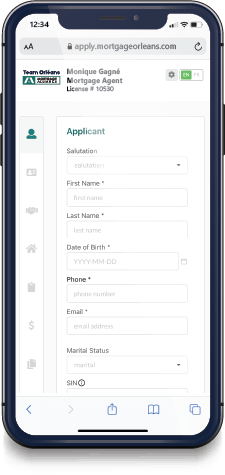

Apply online or schedule a meeting with our team.

Review our scenarios and determine which strategy meets your needs.

You receive your commitment and sign on the dotted line. Easy Peasy.

We negotiate with these lenders, so you don’t have to

Nous négocions avec ces prêteurs, pour que vous n'ayez pas à le faire

and many more.